MacroInsight / Click here for full PDF version

Author(s): Luthfi Ridho ;Samantha Junita

- Rupiah depreciated by -5% YTD/-2.9% mom/-5.8% yoy MTD vs.-3.2% YTD/-0.4% mom/-2.8% yoy in Mar24.

- We believe the main source of the faster depreciation is from bondmarket outflow at US$2.2bn in mid-Apr24 (-US$2bn in Mar24).

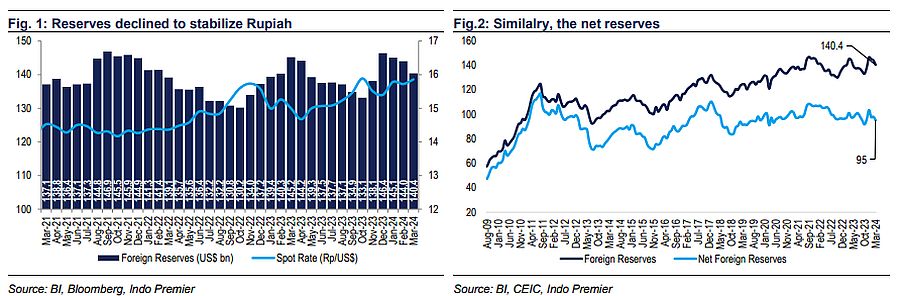

- BI has depleted US$6bn of FX reserves as of Mar24 and further by c.4bn MTD, based on our estimates. Shall Rupiah weaken further, we believe a +50bp BI rate adjustment is inevitable.

FX reserve alone may be insufficient to stabilize Rupiah

As rising geopolitical tension has impacted currency destabilization across EMs (see fig. 4), we think using solely the FX reserve may be insufficient to defend the Rupiah if the pressure prolonged.Rupiah depreciation went deeper to -5% YTD/-2.9% mom/-5.8% yoy in mid Apr24 to c.Rp16.2k/US$ (-3.2% YTD/-0.4% mom/-2.8% yoy at Rp15.7k/US$ in Mar24), a level never seen in the last 4 years. As of Mar24, BI have depleted the FX reserves by US$6bn to stabilize the Rupiah and we think as much as c.US$4bn had been used in mid-Apr24 alone. Despite the heavy use of the FX reserves, we see minimum impact to the Rupiah volatility (tripled since end of Mar24 at around 4.0 index point to around 13.5 index point in mid-Apr24). Hence, we believe adjustment to the BI rate might be needed to help stabilize the Rupiah.

Rupiah depreciation largely due to bond outflows

We believe the main source of the depreciation emanated from bond market outflow at US$2.2bn in mid-Apr24 (-US$2bn in Mar24). We see the outflow to be triggered by flight to safety and thinner yield spread. As of mid-Apr24, the spread between Indonesia-US 10y government bond yield stood at 220bp (see fig. 3), lower than the spread of 250bp by end Mar24 or at 270bp in the beginning of the year. The steep increase in 10y UST yield was also influenced by the geopolitical tension since more budget financing might be needed by the US government. Rising geopolitical tension in the near-term may result in prolonged outflow, in our view.

Increase in oil price may exacerbate the currency depreciation

We believe the increasing oil price by roughly 20% YTD will also affects the pace of Rupiah depreciation. With the oil & gas trade deficit at roughly around c.40mn barrels/month, the persistent increase in oil price will impact to higher onshore demand for US$. In addition, the peak of dividend repatriation season will start in 2Q24 at c.US$10bn on average/quarter. All-in-all, we see the onshore US$ demand will be on the increasing trajectory, which indicates more depreciation pressure other than the bond market outflow.

Sumber : IPS

powered by: IPOTNEWS.COM